Kredivo Leads Paylater Surge in Indonesia

The Paylater financial services industry in Indonesia has experienced rapid growth in recent times, marked by the emergence of several new players in the sector. This phenomenon confirms that Paylater services have become an effective solution to address the credit access gap in Indonesia, allowing people to easily and quickly obtain financing.

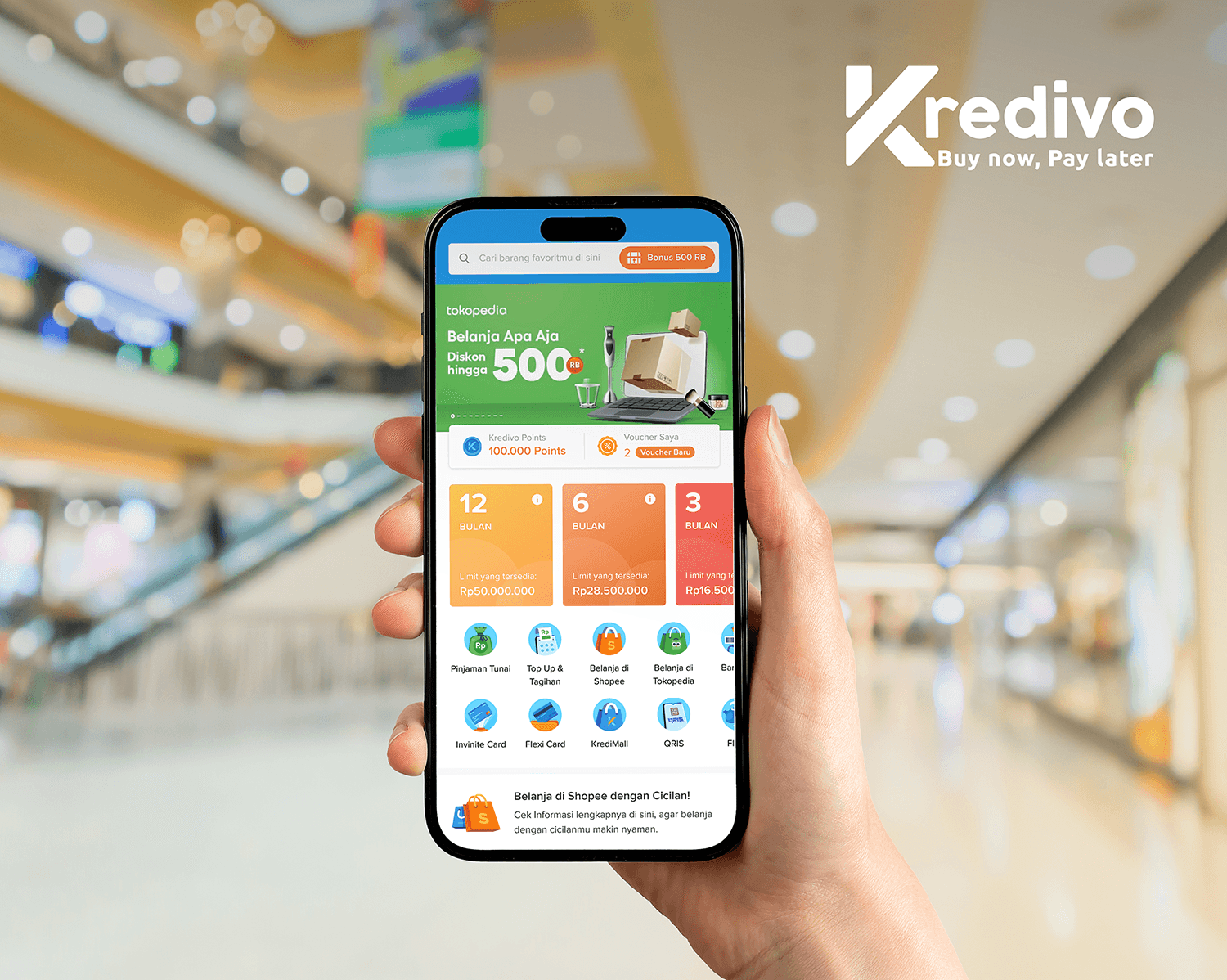

One of Artemis Indonesia's clients - Kredivo, as a pioneer in this industry, has been operating for seven years and is committed to expanding credit access for the public. In the last five years, the number of Kredivo users has increased twentyfold (20x), demonstrating the popularity and success of this service.

Indina Andamari, SVP Marketing & Communications at Kredivo, stated, "Kredivo was founded in 2016 to address the credit access gap and underbanked population in Indonesia. We focus on helping people open their first credit access and build a credit score, becoming a gateway to other financial services." Kredivo has now become a leading Paylater brand with nearly 10 million users and integration with thousands of online and offline merchants in Indonesia.

The growth of the Paylater industry is also reinforced by an increase in user contracts by 33.25% YoY nationwide. Paylater's advantage in providing easier access to first-time credit compared to conventional financial institutions is key to its success. Kredivo is optimistic about leading the market with its inclusive and accurate e-KYC process and its presence both online and offline.

Easy access to credit in Paylater helps people build credit scores, opening doors to larger credit facilities such as vehicles and mortgages. The 2023 Indonesian e-Commerce Consumer Behavior Report shows that 60% of Paylater users consider it their first credit, reinforcing Paylater's role as a driver of financial inclusion and public welfare.

Kredivo, through Kredivo Group, has undergone four rounds of institutional funding from Seed to Series C in its seven years of operation. More than five leading conventional financial institutions have also channeled credit through Kredivo, demonstrating the financial sector's confidence in this innovative business model.

In the future, Kredivo remains committed to strengthening its business fundamentals, expanding, and venturing into other financial services. With the positive growth of the Paylater industry, Kredivo is confident in continuing to play a leading role in the market, maintaining positive growth momentum amid the evolving dynamics of the industry.